by Dennis Crouch

In CQV Co., Ltd. v. Merck Patent GmbH, No. 2023-1027 (Fed. Cir. Mar. 10, 2025), the Federal Circuit vacated and remanded a PTAB post-grant review (PGR) decision that had upheld the validity of Merck's patent against sales of a commercially available product. This case highlights a significant divergence between the evidentiary standards for proving prior art status in district court litigation versus AIA trials. It also sets up another increasingly common scenario where neither the patentee nor the patent challenger are US entities. Here, Merck is German and CQV is Korean.

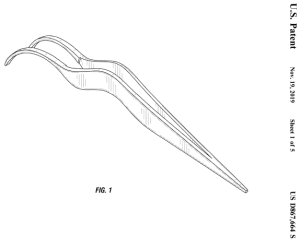

Merck's US10647861 covers transparent α-alumina flakes with specific characteristics that are used in pearlescent pigments for various applications including automobile paint. CQV, a competitor in the pigment market, filed a post-grant review petition challenging claims 1-22--arguing that Merck's commercially available Xirallic product (specifically "Sample C") disclosed the invention and rendered the claims obvious.

Unlike in IPR proceedings, where petitioners are limited to patents and printed publications as prior art, PGR allows challenges based on any ground of invalidity, including prior art products that were "on sale" or "otherwise available to the public" as here. This case particularly focuses on how much certainty is required to establish that a product qualified as prior art under the "preponderance of the evidence" standard used in PGR proceedings.

To continue reading, become a Patently-O member. Already a member? Simply log in to access the full post.